price to cash flow from assets formula

Cash Ratio Cash Cash Equivalent Total Current Liabilities. Share Price or Market.

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

Cash Ratio 07.

. Thus if the price to cash flow ratio is 3 then the. FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures. How to Create Positive Cash Flow.

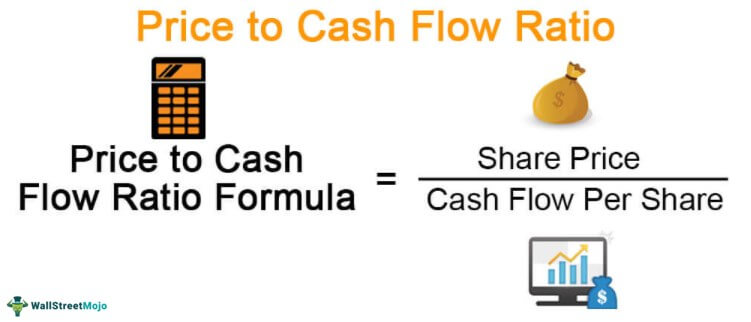

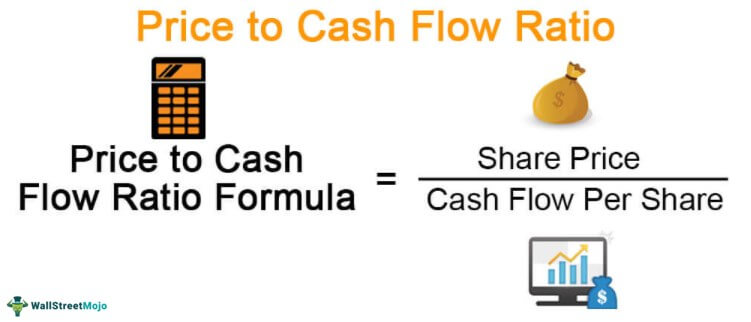

Price to Cash flow Ratio. The Price to Cash Flow ratio formula is calculated by dividing the share amount by the operating cash flow per share. Current Stock Price Cash Flow per Share.

In case of Frost we need to estimate operating cash flows and then work out PCF. The cash flows to total assets ratio shows investors how efficiently the business is at using its assets to collect cash from sales and customers. A cash flow multiple of 5 means that the company is worth 5x its cash flow.

Put a value in the formula. OCF Net Income Depreciation Amortization Change in WC Any other non-cash item. The number you receive when using this formula is called a cash flow multiple.

Example of Cash Returns on Asset Ratio. You can be a profitable company but if you dont have cash moving around to pay bills then you are really in trouble. Cash flow from operations cash flow from investing activities and cash flow from financing.

In practical terms it would not make sense to calculate FCF all in one formula. Cash flow is often overlooked when people analyze a company. So the cash ratio is 07.

Share Price or Market. The price to cash flow ratio tells the investor the number of rupees that they are paying for every rupee in cash flow that the company earns. Example of the Price to Cash Flows Formula.

Management can generate positive cash flow. -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets. 50 15.

Price to Cash Flow Share Price. Operating Cash Flow can be calculated using the following formula. The cash flow statement defines three types of cash flow.

The CF or cash flow found in the denominator of the ratio is obtained through a calculation of the trailing 12-month cash flows generated by the firm divided by the number of. Operating cash flow formula is represented the following way. Lets consider the example of an automaker with the following financials.

An example of calculating the price to cash flows would be to assume that a company has a market cap of 500 million. Cash Ratio 50000 20000 100000. These 3 types of cash flow totaled.

In other words for. Cash returns on assets cash flow from operations Total assets. EBIT profit from the main activity ie the amount of the companys profit before.

OCF EBIT DA-T where. The higher the ratio the more efficient the.

Price To Cash Flow Ratio P Cf Formula And Calculation

How Do I Use The Accounting Equation In My Business Small Business Finance Cash Flow Statement Sell Your Business

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Time Of Book Value Meant To Be Accounting Books

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Investing Activities Small Business Accounting Financial Statement Cash Flow Statement

Statement Cash Flows Powerpoint Diagrams Cash Flow Cash Flow Statement Business Powerpoint Templates

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

Ifrs 9 Business Model And Sppi Testing Financial Asset Business Financial Instrument

Present Value Of Uneven Cash Flows All You Need To Know Financial Life Hacks Cash Flow Financial Management

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

Price To Cash Flow Formula Example Calculate P Cf Ratio

Formula For Cash Flow Economics Lessons Accounting Education Accounting

Myeducator Business Management Degree Accounting Education Accounting Classes

Internal Rate Of Return Irr And Mirr Meaning Calculation And Use Cash Flow Investing Money Business Case

Cash Flow Formula How To Calculate Cash Flow With Examples

Small Business Accounting Archives Mirex Marketing Small Business Accounting Bookkeeping Business Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)