b&o tax states

The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US. Washington has a gross receipts tax.

Marketplace facilitators such as Amazon typically collect sales tax at the retail sales rate which ranges from 7 to 105 depending on location and industry.

. A one-time 4000 city. Washington unlike many other states does not have an income tax. 2020 a 20 increase to Washington states business and occupation BO tax goes into effect increasing the tax burden on health care providers including independent.

Slaughtering Breaking and Processing Perishable Meat. Soybean Canola Processing00138. B Amp O Tax Guide City Of Bellevue Come to New York where you can pay the second.

But service businesses pay a 15 rate. While deductions are not permitted for labor materials or other overhead expenses the State of Washi. The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax.

Kenmores BO tax applies to heavy manufacturing only. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. Service and Other Activities.

Commonly the percentage runs about 5 or half a percent. Commercial Parking Business BIMC 510. This article authored by Scott Schiefelbein and Robert Wood 2 provides helpful tips regarding some of the nexus traps the BO tax poses for the unwary company seeking to do business in Washington and was originally published in the spring issue of the Oregon State Bar Taxation Section Newsletter.

Unlike the retail sales tax a sale does not have to occur for a. Has more than 100000 in combined gross receipts sourced or attributed to Washington. Unlike the retail sales tax a sale does not have to occur for a.

A lawsuit challenging the constitutionality of the additional tax was filed in November 2019. It is measured on the value of products gross proceeds of sale or gross income of the business. Extracting Timber Extracting for Hire Timber003424.

Contact the city directly for specific information or other business licenses or taxes that may apply. Mechnically you simply pay a percentage of your gross receipts. The major classifications and tax rates are.

May 13 2020. Businesses Exempt from City BO Tax - BIMC 388 505090 508 states that the Citys BO Tax does not apply to certain business activities to which tax liability is imposed by other meansBusiness activities not subject to BO Tax are. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

Heres how the state BO works. It is a type of gross receipts tax because it is levied on gross income rather than net income. Business and Occupation Tax.

Not at all say business owners. A one-time 4000 city. Business and occupation tax overview.

However your business may qualify for certain exemptions deductions or credits. A Washington State superior court granted summary judgment for banking associations holding that the states additional 12 business and occupation BO tax imposed on certain financial institutions violates the Commerce Clause of the US. International Charter Freight Brokers.

In business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. Business registration is done through the State of Washington Business Licensing Service. The Washington state business occupation tax works really simply.

And 39 cities in the stateincluding Seattlehave gotten in on the action imposing their own versions of the BO on top of the state tax. Manufacturing Wheat into Flour. The BO tax for labor materials taxes or other costs of doing business.

A similar proposal to repeal a BO tax exemption for in-state representatives of out-of-state sellers claims to raise 155 million in the current budget and 199 million in the next budget but admits that the exemption currently costs just 5 million a year in revenue. Bo tax states Wednesday May 18 2022 Edit. The first 1000000 in taxable gross receipts are taxed at 150 minimum tax due and any gross receipts above that are taxed at 026.

Washingtons BO is an excise tax. Washingtons BO tax is calculated on the gross income from activities. The state BO tax is a gross receipts tax.

If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s. And some businesses pay lower rates. Both Washington and Tacomas BO tax are calculated on.

V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered. Businesses with 150000 or more in revenues attributable to Ohio are responsible for paying Ohio Gross Receipts Tax Commercial Activity Tax either annually or quarterly. 32 rows B.

While deductions are not permitted for labor materials or other. How eliminating a 5 million exemption will raise 75-100 million a year. The nexus determination for sales tax is similar to the BO.

The Washington State Supreme Court today September 30 2021 upheld the constitutionality of the states business and occupation BO tax surcharge imposed on certain financial institutions. The term semiconductor materials means silicon crystals silicon ingots raw polished semiconductor wafers and compound semiconductor wafers. This means there are no deductions from the BO tax for labor.

First enacted as a temporary funding mechanism in 1933 it has been amended tweaked and updated to include hundreds of exemptions exceptions and classifications. Effective December 1 2006 the business and occupation BO tax rate for persons engaged in manufacturing or processing for hire semiconductor materials is reduced to 0275 percent. And thats an advantage that is often ignored.

Lawsuit challenging the additional BO tax. Athletic Exhibitions BIMC 505090Casual and Isolated Sales. The tax amount is based on the value of the manufactured products or by-products.

Extracting Extracting for Hire00484. Have a local BO tax. States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky.

Bo tax states Tuesday May 3 2022 Edit. The additional tax is imposed at a rate of 12 of gross income taxable under the Service and Other Activities classification thus making the effective BO tax rate for these institutions 27. Constitution because it discriminates against out-of-state financial institutions.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Washington unlike many other states does not have an income tax. Out-of-state taxpayers earning apportionable income attributable to Washington are required to apportion their revenue and report to Washington.

The state BO tax is a gross receipts tax.

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

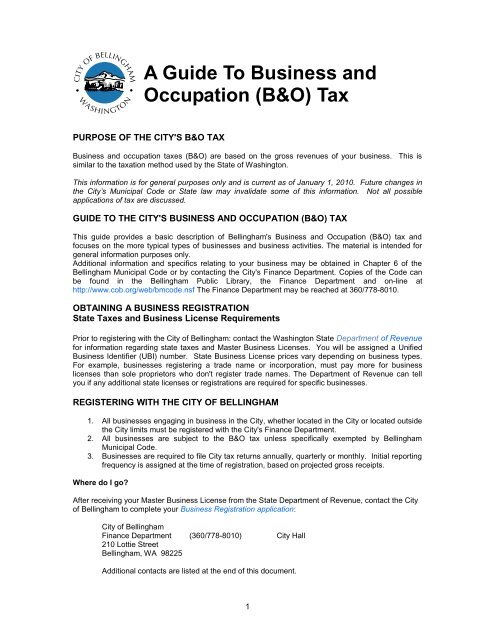

B Amp O Tax City Of Bellingham

Why Our B O Tax Is Unfair R Seattlewa

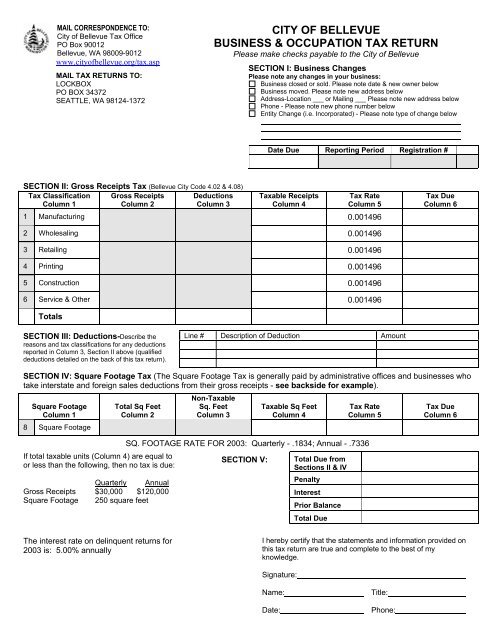

B Amp O Tax Return City Of Bellevue

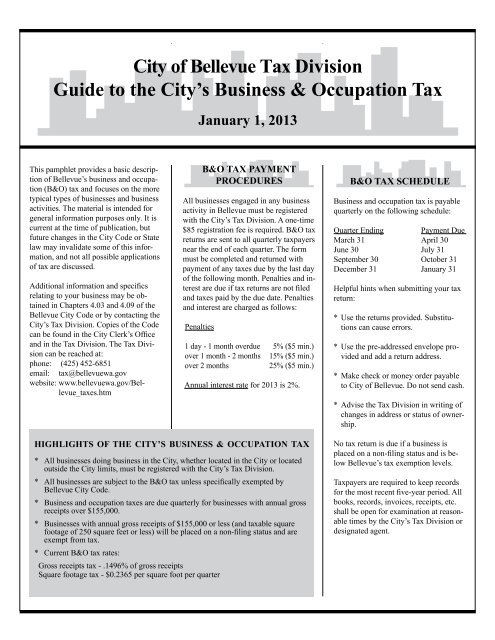

B Amp O Tax Guide City Of Bellevue

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

The Infamous B O Tax Seattle Business Magazine

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

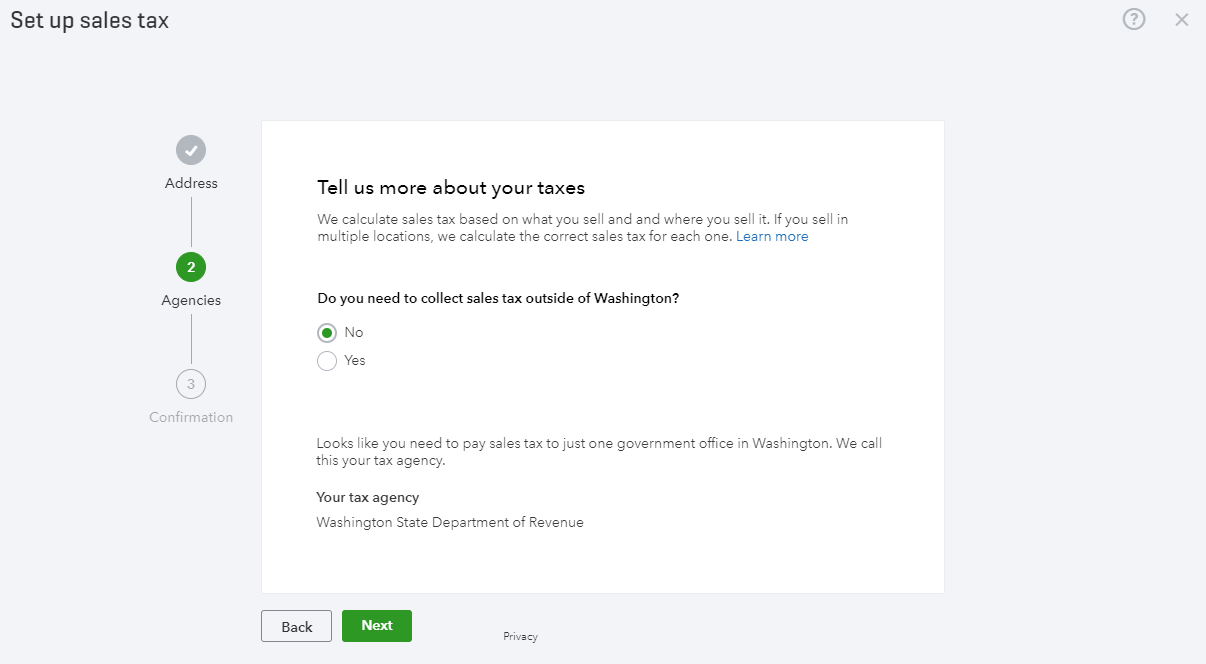

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

First Produciton 747 100 Nose Section Is Mated With Wing Section Boeing Aircraft Aviation Mechanic Aircraft

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Model Trains

World S Largest Airplane Photographic Print Allposters Com In 2021 Boeing 747 Boeing World

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Business And Occupation B O Tax Washington State And City Of Bellingham

Kalitta Air Boeing 747 222b Sf N793ck Boeing 747 Boeing Cargo Aircraft

%20Taxes/bo-tax-header.jpg)